(Bloomberg) — China is shipping tons of used cooking oil to the U.S., saying the biofuels industry has the potential to pollute, prompting U.S. farmers and President Joe Biden to push for climate-friendly energy. This is causing a blow to the promotion of

Most Read Articles on Bloomberg

According to the U.S. International Trade Commission, U.S. imports of used cooking oil, the raw material for renewable diesel, will more than triple in 2023 compared to the previous year, with more than 50% of that coming from China. U.S. industry groups and biofuel executives are increasingly concerned that a significant amount of these supplies are adulterated and are calling on the government to increase oversight of imports.

Suspicions arose after Europe’s biofuels industry raised similar concerns last year about Chinese-made cooking oil. Used cooking oil has a better carbon intensity score than widely produced feedstocks in the United States, such as raw soybean oil, so potentially contaminated imports will be used by Biden at the expense of American farmers. Benefiting from renewable energy incentives.

Read more: Asia floods Europe with suspected fraudulent green fuel

“We’re putting more pressure on the U.S. government to reveal what it’s actually importing,” he said. Todd Becker, CEO of Green Plains, said: “Someone needs to understand that this is not the only cooking oil the Chinese used.”

Contaminated used cooking oil can make a difficult situation even worse for farmers and agricultural companies. Companies such as Bunge Global SA and Archer-Daniels-Midland Co. are banking on a surge in demand for crop-based green diesel feedstock, but competition from foreign imports is eating into profits and ambitious expansion plans is endangering. More broadly, illegal shipments risk exacerbating trade tensions between China and the United States.

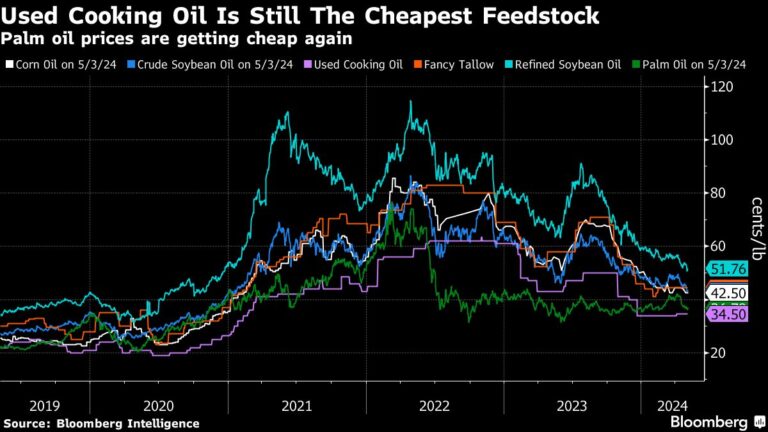

Imports of used cooking oil (UCO) will reach 1.4 million tons (3.1 billion pounds) in 2023, squeezed from more than 6% of U.S. soybeans that were crushed to make soybean oil last season. Equivalent to oil. In addition to having a better carbon intensity score, UCO is also about one-third cheaper than refined soybean oil.

Read more: Surge in imports of green diesel feedstock disrupts US soybean market

One of the biggest concerns is that Chinese shippers are adding UCOs to fresh palm oil. Palm oil, the world’s most widely used vegetable oil, has become a hot topic among environmentalists and many, as the industry is not only linked to labor abuses, but is also a major cause of deforestation in countries such as Indonesia. It has become a source of trouble for the country.

China’s Ministry of Commerce did not respond to a faxed request for comment.

The agency has been consulting with industry stakeholders, including the National Oilseed Processors Association, about concerns about increased imports of UCO and other food waste, said Nick Conger, an agency spokesman. That’s what it means. He said the EPA is aware of the increase in imports, which will increase the amount of biofuels required by the Renewable Fuels Standard Program, the law that mandates how much biofuels must be blended into the nation’s fuel supply each year. “This will be an element in establishing and implementing the system,” he said.

The RFS requires producers who use animal waste, such as UCO or tallow, to maintain records pledging that the ingredients meet the legal definition of “renewable biomass,” and to provide a description of the ingredients. It is mandatory to identify the process used to obtain it.

“Unless EPA and other agencies address this issue quickly, the integrity of the renewable fuels standard could be compromised,” Renewable Fuels Association CEO Jeff Cooper said in an interview. I’m concerned about that,” he said.

Clean Fuels Alliance America, which represents renewable diesel and sustainable jet fuel producers, is directed by its board to investigate the possibility of a surge in UCOs and illicit gallons entering the U.S. from China It was done.

“Our goal is to protect our members and combat any unfair trade practices we discover,” said Paul Winters, Director of Public Affairs and Federal Communications. “We don’t think practices are unfair just because there’s more trade,” he said, but the alliance wants to ensure that domestic raw materials are not exposed to unfair competition from imports. There is.

The surge in UCO imports is also a top concern for NOPA, the trade group representing the U.S. seed processing industry for soybeans, canola, and other crops. CEO Kylie Tokaz Buller said the group has been in discussions with federal lawmakers and government agencies such as the EPA and the U.S. Department of Agriculture.

Asia is by far the world’s largest supplier of UCO, led by China. The European Union launched an investigation into imports from Asia last year at the request of European biodiesel producers, but the request was rejected. Producers did not specify the reason for the change, but noted that shipments of biodiesel from China’s Hainan Island, a hotspot for green fuels, to the EU were halted soon after the investigation began.

“There are a lot of allegations, a lot of stories and anecdotes floating around,” Cooper said. “It’s like one of the worst kept secrets out there that this is happening.”

–With assistance from Jennifer A. Dlouhy and Gerson Freitas Jr.

(Comments from industry organizations added after the 12th paragraph)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP