US Embedded Finance Business and Investment Opportunity Market

DUBLIN, May 20, 2024 (Globe Newswire) — “US Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs for Embedded Lending, Insurance, Payments and Wealth Sectors – Updated Q1 2024” report has been added. ResearchAndMarkets.com Recruitment.

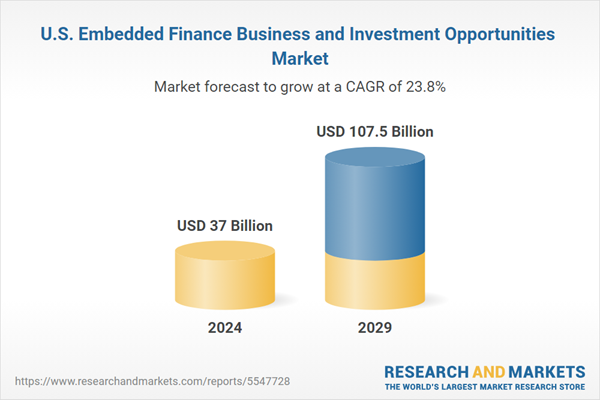

The embedded finance industry in the United States is expected to grow by 33.0% annually to reach USD 36.99 billion in 2024. The embedded finance industry is expected to grow steadily during the forecast period, registering a CAGR of 23.8% from 2024 to 2029. The country’s embedded finance revenue is expected to reach USD 107.51 billion by 2029, up from USD 36.99 billion in 2024.

The report provides an in-depth data-centric analysis of the embedded finance industry, covering market opportunities and risks across various sectors in lending, insurance, payments, and asset-based finance sectors. The report includes 75+ KPIs at country level to provide a comprehensive understanding of Embedded Finance market dynamics, market size, and forecast.

The embedded financial landscape in the United States is rapidly evolving, improving access to financial services for platforms, businesses, and end users. Embedded finance has evolved from a specialized product to an essential component in the arsenal of any thriving platform.

Leading companies in industries as diverse as e-commerce (e.g., eBay, Shopify), food delivery (e.g., Uber, DoorDash), and digital banking (e.g., Tide) are all using integrated financial services to improve the overall merchant experience. We are hiring. . Rather than relying solely on traditional financial institutions, users are now leaning towards seamlessly integrating payment solutions, lending options, insurance services, and other financial features into their everyday software.

This growth is due to increased demand for digital financial services, rising user expectations, and the launch of open banking in the US. Additionally, embedded finance is expanding across industries such as retail, healthcare, education, and mobility.

Benefits of embedded finance in the US: Businesses can benefit greatly from embedded finance. The wide range of services facilitated by SaaS 3.0 allows embedded finance providers to serve a variety of American businesses. Here are some examples of major industries in the United States.

E-commerce: The U.S. e-commerce sector recorded approximately $768 billion in sales revenue last year as an increasing number of businesses moved online to adapt to the digital economy. Major companies such as Amazon and Shopify stand to gain significantly by integrating financial services into their platforms and providing added value to merchants. By offering financial services within the same ecosystem, platforms can strengthen merchant loyalty and drive sales growth through new business financing options.

Commercial Banking: With annual industry revenues of $838.5 billion, commercial banking generates revenue primarily through lending to customers and businesses. However, regulatory constraints, complex procedures, and traditional credit assessment methods pose challenges to lending to a wide range of individuals and businesses. Embedded finance offers both traditional and challenger banks the opportunity to overcome these hurdles by seamlessly integrating lending services into their services.

Small and medium-sized enterprises (SMEs): Despite their importance, small and medium-sized enterprises often face difficulties in accessing the financing they need to grow. Traditional banks struggle to provide financing to emerging digital companies that don’t have established revenue histories or traditional credit metrics. But with alternative embedded finance solutions, banks can provide easy and flexible financing to any business that needs it, regardless of its stage of development.

Innovation in the US: Over the past year, large companies and technology platforms have offered a broader range of financial products, targeting customer segments traditionally served by traditional banks.

Deliver an EF-like experience in-house: Embedded finance has significantly raised the bar for customer experience in the banking sector. This advancement has led major banks to consider incorporating insights from embedded finance into their banking services. For example, Key Bank launched Laurel Road, a digital platform customized for healthcare professionals, whose flagship product is student loan refinancing. Similarly, American Express introduced the Plan It feature. This will allow cardholders to convert standard credit card purchases into installment loan repayment plans similar to the emerging credit card disruptor’s popular Buy Now, Pay Later (BNPL) service .

In the United States, digital banking is gaining prominence as consumers prefer to conduct banking transactions through mobile applications. This digital push has driven growth in the embedded finance industry over the past few years. From buy-now-pay-later payment solutions to insurance offerings, embedded financial solutions have become the new normal for most businesses in the United States.

Key barriers to embedded finance in the US: One of the key challenges facing embedded finance is regulatory compliance. Due to the strict regulations in the financial services sector, there can be regulatory hurdles when integrating financial products into non-financial platforms. Embedded finance providers must comply with various regulations such as data privacy, consumer protection, and anti-money laundering.

In the United States, embedded finance providers have adopted several strategies to address regulatory compliance. First, both companies partner with established financial institutions that already comply with the necessary regulations. Second, it seeks the necessary licenses and regulatory approvals to function as a financial institution itself. Although this process can be time-consuming and expensive, it gives embedded finance providers more control over their products and services.

Key players: Key players in the U.S. embedded finance industry include Amount, Cross River, Plaid, and YouLend. In the United States, financial services as embedded financial solutions are becoming mainstream. Banks and platforms have a huge opportunity to serve North America’s more than 30 million small and medium-sized businesses.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast period |

2024-2029 |

|

Estimated market value in 2024 (USD) |

$37 billion |

|

Projected market value to 2029 (USD) |

$107.5 billion |

|

compound annual growth rate |

23.8% |

|

Target area |

America |

range

US embedded finance market size and forecast

Embedded finance by major sectors

-

retail

-

logistics

-

Telecommunications

-

manufacturing industry

-

consumer health

-

others

Embedded finance by business model

-

platform

-

patron

-

Regulatory body

Embedded finance with a decentralized model

-

unique platform

-

Third party platform

US embedded insurance market size and forecast

Built-in insurance by industry

-

Insurance built into consumer products

-

Built-in insurance in travel and hospitality

-

insurance built into the car

-

Insurance integrated into medical care

-

Insurance built into real estate

-

Built-in insurance in transportation and logistics

-

insurance embedded in someone else

Built-in insurance by consumer segment

Built-in insurance by offer type

Built-in insurance by business model

-

platform

-

patron

-

Regulatory body

Embedded insurance by distribution model

-

unique platform

-

Third Party Platforms

Embedded insurance by sales channel

-

embedded sales

-

Bank sales

-

Broker/IFA

-

tied agent

Built-in insurance by insurance type

Embedded insurance in the non-life insurance field

US Embedded Loan Market Size and Forecast

Embedded lending by consumer segment

-

business loan

-

personal loans

Embedded financing by the B2B sector

-

Embedded financing in retail and consumer goods

-

Embedded financing in IT and software services

-

Embedded financing in media, entertainment and leisure

-

Embedded financing in manufacturing and distribution

-

Loans embedded in real estate

-

Other embedded financing

Embedded financing with the B2C sector

-

Embedded financing in retail shopping

-

Loans integrated into home renovations

-

Embedded financing in leisure and entertainment

-

Embedded financing in healthcare and wellness

-

Other embedded financing

Embedded Loans by Type

-

BNPL financing

-

POS rental

-

personal loan

Embedded financing by business model

-

platform

-

patron

-

Regulatory body

Embedded financing with distribution model

-

unique platform

-

Third party platform

US embedded payment market size and forecast

Embedded payments by consumer segment

Built-in payment by end-use department

-

Embedded payments in retail and consumer goods

-

Payments embedded in digital products and services

-

Payments embedded in utility bill payments

-

Embedded payments in travel and hospitality

-

Embedded payments in leisure and entertainment

-

Embedded payments in health and wellness

-

Payments built into office supplies and equipment

-

Other embedded payments

Built-in payments by business model

-

platform

-

patron

-

Regulatory body

Incorporating a decentralized payment model

-

unique platform

-

Third party platform

US Embedded Wealth Management Market Size and Forecast

Market size and forecast for the US asset-based financial management industry

Asset-based finance by asset type

Asset-based finance by end users

For more information on this report, please visit https://www.researchandmarkets.com/r/qea1rg.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900