Singapore’s Embedded Finance Business and Investment Opportunities Market

Dublin, May 28, 2024 (GLOBE NEWSWIRE) — The “Singapore Embedded Finance Business and Investment Opportunity Databook – 75+ KPIs for Embedded Lending, Insurance, Payments and Affluent Segments – Updated Q1 2024” report has been added. ResearchAndMarkets.com Recruitment.

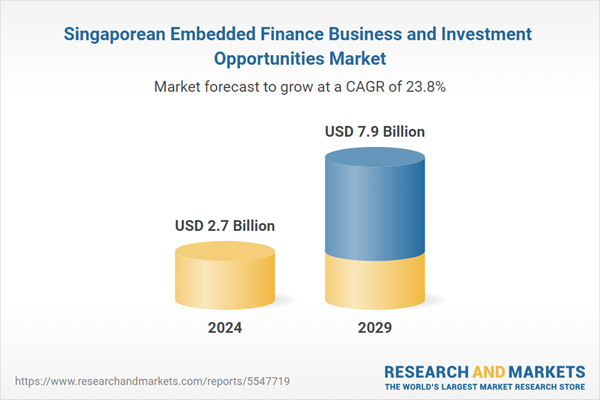

Singapore’s embedded finance industry is expected to grow at 33.5% on an annual basis to reach USD 2.7 billion in 2024. The embedded finance industry is expected to grow steadily during the forecast period, registering a CAGR of 23.8% between 2024 and 2029. The country’s embedded finance revenue will increase from USD 2.7 billion in 2024 to USD 7.85 billion by 2029.

The report covers market opportunities and risks for lending, insurance, payments, wealth and asset-based finance sectors across various verticals and provides an in-depth data-centric analysis of the embedded finance industry. With 75+ KPIs at country level, the report provides a comprehensive understanding of embedded finance market dynamics, market size and forecast.

Singapore’s embedded finance market is poised to experience rapid growth in 2024 due to a confluence of factors including a tech-savvy population, a supportive regulatory environment and a burgeoning digital commerce sector. Embedded finance seamlessly integrates financial services into non-financial platforms, allowing businesses to offer financial products such as payments, loans and insurance directly within the user experience. With a strong financial infrastructure and focus on innovation, Singapore is poised to become a regional leader in embedded finance.

There are several key factors driving the growth of the market.

-

High mobile and internet penetration: Singapore boasts a highly connected population with over 80% smartphone ownership, creating fertile ground for embedded financial solutions accessible through mobile apps and online platforms. With an estimated 400 million internet users, Southeast Asia has the potential for breakthrough digital technologies and rapid innovation.

-

Supportive regulatory environment: The Monetary Authority of Singapore (MAS) has a forward-thinking approach to fintech regulation that fosters innovation while maintaining financial stability. Initiatives such as the FinTech Regulatory Sandbox allow startups to test their embedded finance solutions in a controlled environment.

-

Demand for seamless financial experiences: Consumers increasingly expect frictionless, integrated experiences across all digital touchpoints. Embedded finance meets this demand by integrating financial services into everyday activities like shopping and booking travel.

-

The rise of e-commerce and platform-based businesses: The growth of e-commerce platforms and other digital marketplaces creates new opportunities for embedded financing solutions. Businesses can offer financing options such as buy now, pay later (BNPL) at the point of sale, improving conversion rates and customer satisfaction.

Key innovations and transactions in Singapore’s embedded finance market:

-

Singapore as an Embedded Finance Hub: KPMG launches Singapore’s first Embedded Finance Hub. The Embedded Finance Hub aims to accelerate the adoption of embedded finance in Singapore and overseas. Supported by the Monetary Authority of Singapore (MAS), the hub will focus on developing joint capabilities between corporates and financial institutions to create new growth opportunities and centralize and distribute global knowledge and best practices across all sectors. By embedding finance, businesses will generate revenue from new opportunities, deliver better customer experiences, and increase customer retention by seamlessly integrating financial products and services into their business.

-

In 2024, Funding Societies, Southeast Asia’s largest integrated SME (small and medium-sized enterprises) digital finance platform, announced a strategic partnership with Singapore E-Business (SGeBIZ), a digital procurement, payment and sourcing platform provider. The partnership will provide B2B (business-to-business) embedded finance (EmFi) solutions to businesses in Singapore, delivering Funding Societies’ digital finance capabilities through “buy now, pay later” (BNPL) functionality offered within its procurement solution, EzyProcure.

Embedded finance startups in Singapore: Singapore is home to 66 embedded finance startups, including Bolttech, Atome, Decentro, Crayon Data, and MatchMove.

-

Bolttech: Insurance service solutions for businesses and individuals. It connects insurers, distribution partners and customers to transform the way insurance is bought and sold. It offers coverages like mobile phone insurance, travel insurance, etc. It also offers claims and on-demand services. It also offers device repair and valuation services.

-

Atome: An online marketplace offering products in multiple categories for purchasing finance. The platform offers deferred purchase and consumer financing solutions. The product catalog includes beauty, fashion, home décor, baby care, electronics, and more. The mobile application is available on Android and iOS platforms.

-

Decentro: A platform that provides open banking API solutions for banks and financial institutions to implement digital banking. It provides APIs for KYC & onboarding, AML & compliance, digital lending, and managing online payment processes. This allows banks and financial institutions to build diverse products in their banking and lending platforms such as account creation, KYC onboarding solutions, lending solutions, card and payment integrations, ledger APIs, etc.

-

Crayon Data: Cloud-based analytics solution for enterprises. It is an AI-powered revenue driving solution for companies in banking, fintech, and travel. The platform provides data cleansing solutions to identify errors and anomalies in datasets. It enables users to develop new feeds based on real-time data processing. Capabilities include Data as a Service, Recommendations as a Service, Customer Experience as a Service, Marketplace as a Service, etc.

A key player in Singapore’s embedded finance market

-

Fintech startups: Innovative startups such as Funding Societies and Grab Financial Group are driving the growth of B2B and B2C embedded financial solutions.

-

Traditional financial institutions: Incumbent banks such as DBS Bank and OCBC Bank are partnering with fintech companies to provide embedded financial solutions within their existing customer base.

-

Technology companies: Technology giants such as Singapore Telecommunications (Singtel) are leveraging their vast user base to offer embedded financial services.

Market Challenges and Considerations: Despite its potential, Singapore’s embedded finance market faces several challenges.

-

Regulatory Compliance: Navigating the evolving regulatory environment can be complex for businesses, especially when it comes to data privacy and security.

-

Data security concerns: Consolidating financial services raises concerns about data breaches and fraud. Strong cybersecurity measures are essential to building trust with consumers.

-

Collaboration between traditional and new players: Encouraging collaboration between established financial institutions and fintech startups is essential for widespread adoption of embedded finance solutions.

Key attributes:

|

Report Attributes |

detail |

|

number of pages |

130 |

|

Forecast Period |

2024 – 2029 |

|

Estimated market value in 2024 (USD) |

$2.7 billion |

|

Market value forecast to 2029 (USD) |

$7.9 billion |

|

Compound Annual Growth Rate |

23.8% |

|

Target area |

Singapore |

For more information on this report, please visit: https://www.researchandmarkets.com/r/8m0qpg

About ResearchAndMarkets.com

ResearchAndMarkets.com is a leading global source of international market research reports and market data providing the latest information on international markets, regional markets, key industries, top companies, new products and latest trends.

Attachments

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900