59 days

With volatility increasing recently, we started looking at some attractive buying opportunities last week. Was this a much-anticipated correction? Is the pullback over now? Or is there more pain ahead?

Exciting weeks ahead market

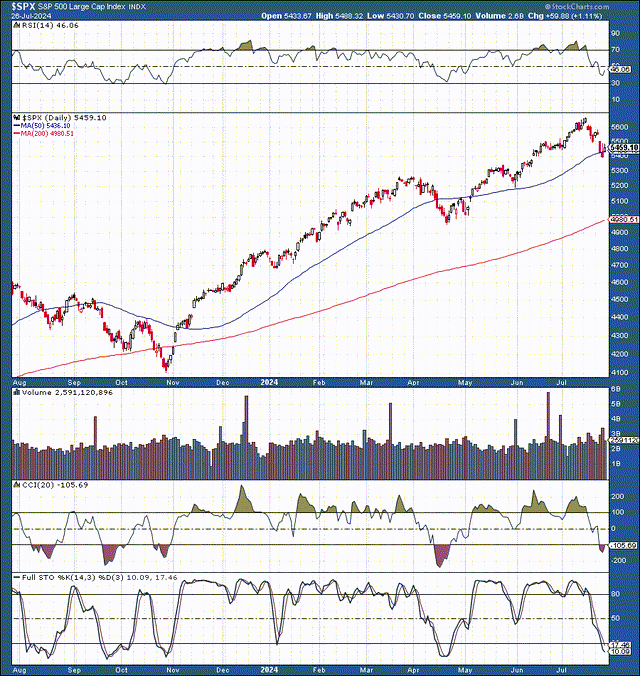

SPX (StockCharts.com | Advanced financial charts and technical analysis tools)

The past few weeks have been exciting, especially since the much-anticipated pullback began. The S&P 500 Index (SP500, SPX) was extremely overbought in the short term and needed to reset. The pullback from peak to trough was 5%. It remains to be seen if this is enough. Still, it is reassuring to see some healthy rotation and constructive pullback in many blue chip stocks that were ahead of the curve both technically and from a valuation standpoint.

From a technical standpoint, key support lies at the 5,400-5,300 levels, with the SPX A constructive bounce from this key support point. While we may see further temporary volatility here in the short term, the medium and long term outlook remains positive and the bullish uptrend remains. Therefore, I view the recent weakness as an attractive buying opportunity and will buy further quality shares if the volatility continues.

Technology – Potential has bottomed out

When it comes to technology, the NASDAQ 100 Index (Nedix) futures, and I also like the Invesco QQQ Trust ETF (QQQ), which is a “Nasdaq 100” ETF. While the SPX fell a textbook 5% during its recent rotation and pullback phase, Nasdaq 100 futures just fell 10%.

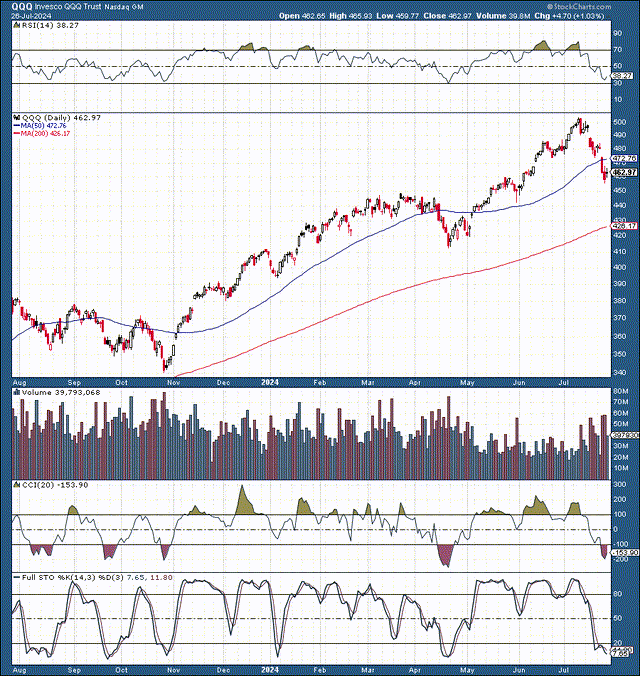

QQQ (StockCharts.com | Advanced financial charts and technical analysis tools)

QQQ has fallen 10% to the $460-450 support/buy zone. We also see QQQ moving from technically very overbought to neutral and now approaching oversold conditions. QQQ has also dropped below the 50-day moving average, as it did during the previous pullback. While a temporary pullback may continue, this is a good time to add to certain technologies. Additionally, while QQQ has fallen 10%, many top technology stocks have been hit in the recent correction.

for example:

- Apple Inc. (AAPL): 10%

- Microsoft Corporation (MSFT): 11%

- NVIDIA Corporation (NVDA): 25%.

- Amazon.com, Inc. (AMZN): 12%.

- Alphabet Inc. (GOOG, GOOGL): 15%.

- Meta Platforms, Inc. (META): 18%.

- Broadcom Inc. (AVGO): 22%.

- Advanced Micro Devices, Inc. (AMD): 27%.

- Tesla Inc. (TSLA): 20%

- Micron Technology (MU): 33%

- Dell Technologies (DELL): 38%

- Snap Inc. (SNAP): 24%.

- SoundHound AI, Inc. (SOUN): 32%.

While some “top stocks” only fell 10-15%, many other mega-gap tech companies fell 20-30% (or more) during their recent offering processes. This movement suggests that tech stocks may be going through a constructive reset process and start rising again soon.

Focus on constructive foundations

Rather than focusing too much on standard short-term market fluctuations, market participants should focus on the favorable medium- and long-term picture for blue chip stocks. Strong earnings, solid economic data, declining inflation and an easing monetary cycle should create a very positive mood for stocks and other risk assets.

Big Tech Earnings in the Spotlight

Many companies are beating revenue and profit expectations and setting higher-than-expected targets for next quarter and the full year. This is the busiest week of the earnings season, with major companies such as Microsoft, AMD, Meta, Apple and Amazon reporting financial results.

Many stocks have been hit hard as tech earnings have soared. So a spectacular performance may not be necessary as stocks are taking a hit anyway. Tech earnings in line with or slightly above expectations may be enough to get the blue chips here back on a long-term upward trajectory. Plus, with an important FOMC meeting and a key jobs report scheduled for this week, tech earnings aren’t the only thing that matters.

This week’s economic data

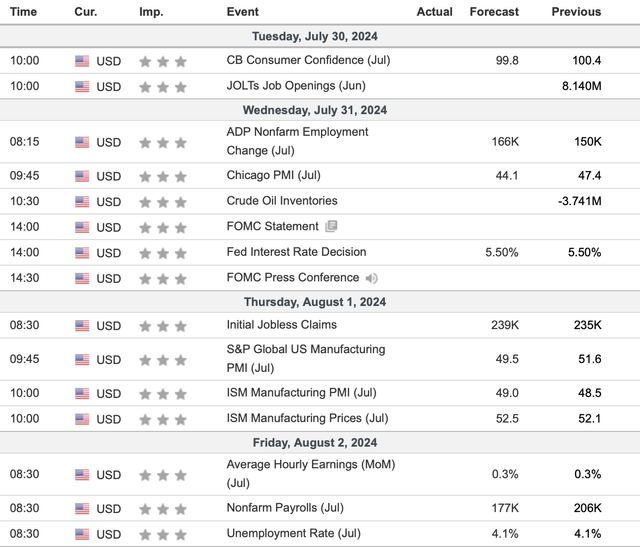

Data (Investing.com – Stock Market Quotes and Financial News)

There is a ton of news to come, but the most important are the FOMC interest rate decision and statement on Wednesday, followed by the all-important nonfarm payrolls release on Friday. There is about a 96% chance that the Fed will keep its benchmark interest rate unchanged. Thus, the market is pricing in “no change” on Wednesday. Still, we would like to see some language indicating that a September rate cut is more likely, which is what the market is pricing in. The market may react negatively to a hawkish tone, as any deviation from a September rate cut could disrupt the current situation.

Could the Fed Cut Rates in September – 25bps or 50bps?

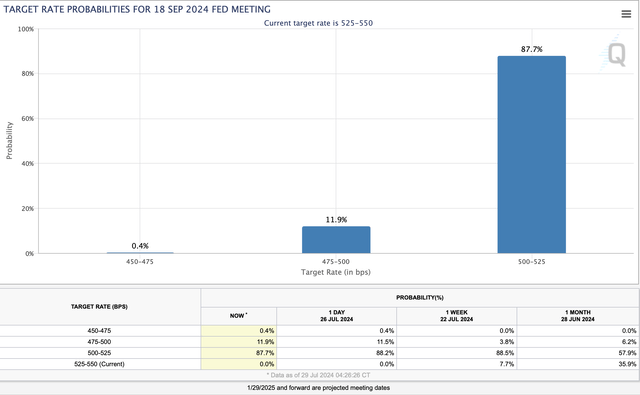

Rate Probabilities (CMEGroup.com)

The probability of a rate cut in September is 100%. The question is whether it will be 25 basis points or 50 basis points. The probability of a 25 basis point cut is about 88%, and the probability of a 50 basis point cut is about 12%. So, the cut is more likely to be 25 basis points, but it will not disappoint the market. The key is to keep cutting rates. Once an easing policy is underway, it is very hard to stop. The Fed may have to tolerate higher inflation in the future, but this could be positive for most risk assets, especially high-quality stocks. There may be a lot of liquidity coming into the market soon, and the surest place for it is high-quality stocks.

Additionally, the likelihood of a 50 basis point move increases, and the upcoming jobs report could increase that likelihood. The market is expecting 177K jobs, and the Goldilocks number could be around 100K-200K. However, we have to walk a delicate tightrope because any number below 100K would seem too weak. We are seeing some softness in the labor market, but we need to avoid a worsening as that could increase the chances of a hard landing or recession, which is what we want to avoid.

Therefore, it is best to keep it below 100,000 and not to have too high employment as it may reduce the chances of a 50 basis point rate cut. Although over 200,000 is not considered catastrophic (because the September rate cut is taken into account), I would still prefer 100,000-200,000 employment. The unemployment rate could stay at 4.2-4.3% or even rise slightly. It is unlikely to fall and we also want to avoid a spike above 4.4%, as this could also increase the chances of a hard landing scenario.

EvaluationEvaluation

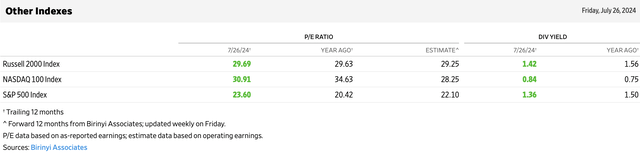

P/E Valuation (WSJ.com)

The SPX has a forward P/E of about 22 and the Nasdaq 100 is only around 28. These P/E ratios are not high, especially considering the more accessible financing environment going forward and the high prospects for future revenue growth, improved efficiencies, positive effects of AI, and other variables that could contribute to faster growth, improved profitability, and wider multiples. The company has a unique and solid combination of constructive factors that should drive the stock price higher moving forward.

We also note the fact that while many of the mega-cap tech stocks whose stocks have soared have seen their P/E ratios revised downward, major average P/E ratios remain roughly at recent levels. P/E ratios have been declining modestly due to increased rotation into small and mid-cap stocks and other sectors. Despite the outlook for near-term volatility, I remain constructive on the SPX and equities in general in the medium and long term. My year-end target range for the SPX remains at 6,000-6,200.