On Sunday, a key congressional committee in the United States approved President Donald Trump’s new tax cut bill, which could pass in the House of Representatives later this week.

The bill extends Trump’s 2017 tax cuts and may add up to $5 trillion to the national debt, deepening worries after a recent US credit ratings downgrade by Moody’s on Friday, which cited concerns about the nation’s growing $36 trillion debt.

The US has the highest amount of national debt in the world and is facing growing concerns about its long-term fiscal stability.

What is US debt?

Debt is simply the total amount of money the US government owes to its lenders, currently amounting to $36.2 trillion. This represents 122 percent of the country’s annual economic output or gross domestic product (GDP), and it is growing by about $1 trillion every three months.

The highest debt-to-GDP ratio was during the pandemic in 2020, when the ratio hit 133 percent. The US is among the top 10 countries in the world with the highest debt-to-GDP ratio.

What is the debt ceiling, and why does it keep increasing?

When the government spends more money than it collects, it creates a deficit.

To cover this deficit, the government borrows more money. To ensure that borrowing is subject to legislative approval, the US Congress sets a limit to how much the government can borrow to fund existing obligations like Social Security, healthcare and defence. This limit is known as the debt ceiling.

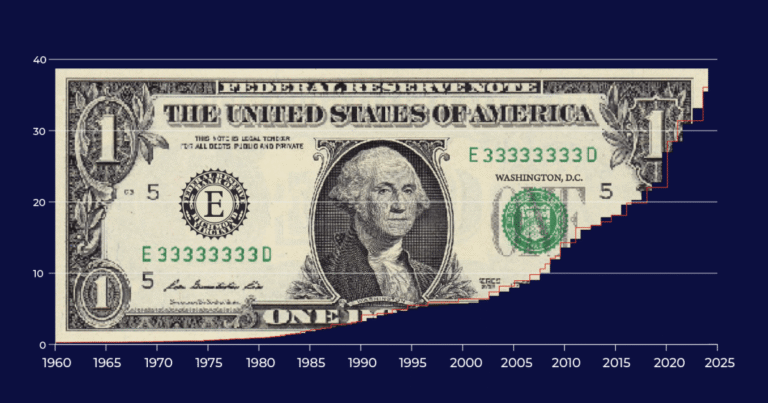

Once the ceiling is reached, the government cannot borrow more unless Congress raises or suspends the limit. Since 1960, Congress has raised, suspended or changed the terms of the debt ceiling 78 times, allowing the US to borrow more money.

The federal deficit under different presidents

The federal deficit is how much more money the government spends than it brings in during a single year. A federal surplus would mean the US is bringing in more money than it is spending.

The deficit grew sharply during Trump’s first term, especially in 2020 during the COVID-19 pandemic, when the government spent heavily while tax revenues dropped due to job losses. That year, the deficit reached nearly 15 percent of the entire economy (GDP).

Under former President Bill Clinton, there was a federal surplus – the result of favourable economic conditions such as the dot-com boom, as well as tax increases which raised more revenues.

What are Treasury bills, notes and bonds?

When the US wants to borrow money, it turns to the Treasury – the finance department of the federal government.

To borrow money, the Treasury sells various types of debt securities, such as Treasury bills, Treasury notes and Treasury bonds to investors.

These securities are essentially loans made by investors to the US government, with a promise to repay them with interest.

US Treasuries have long been considered a safe asset because the risk of the US failing to repay its investors has been very low.

Different debt securities mature over different times – this is when the debt is repaid to the investor.

Treasury bills (T-bills) are short-term and mature within one year

Treasury notes (T-notes) are medium-term and mature between 2 and 10 years

Treasury bonds (T-bonds) are long-term and mature in 20 to 30 years.

Who holds US debt?

Three-quarters of the $36.2 trillion US debt, approximately $27.2 trillion, is held domestically, of which:

$15.16 trillion (42 percent) is held by US private investors and entities, mostly in the form of savings bonds, mutual funds and pension funds.

$7.36 trillion (20 percent) is held by intra-governmental US agencies and trusts.

$4.63 trillion (13 percent) is held by the Federal Reserve.

Among individuals, Warren Buffett, through his company Berkshire Hathaway, is the single largest non-government holder of US Treasury bills, valued at $314bn.

Foreign investors hold the remaining quarter, valued at $9.05 trillion (25 percent).

Over the past 50 years, the share of US debt held by foreign entities has increased fivefold. In 1970, only 5 percent was owned by overseas investors; today, that figure has risen to 25 percent.

Which countries hold the most foreign debt?

Countries buy US debt because it offers a safe, stable investment for their foreign currency reserves, helps manage exchange rates and provides reliable interest income.

Foreign investors hold $9.05 trillion of debt, of which:

Japan holds $1.13 trillion

The United Kingdom holds $779.3bn, overtaking China in March as the second-largest non-US holder of treasuries

China holds $765.4bn

The Cayman Islands ($455.3bn) holds a large amount of US debt because it is a tax haven

Canada ($426.2bn)

In response to Trump’s tariffs, both Japan and China have indicated they will use their substantial holdings of US treasuries as leverage in trade negotiations with the Trump administration.

Earlier this month, Japanese Finance Minister Katsunobu Kato said Japan’s massive holding of US treasuries could be a “card on the table” in trade negotiations.

Similarly, China has been gradually selling US treasuries for years. In February, China’s US treasury holdings dropped to their lowest level since 2009, reflecting efforts to diversify reserves and ongoing trade tensions.

What does high US debt mean for the average American?

If the US government is spending more on debt interest repayments, it can affect budgets and public spending as it becomes more costly for the government to sustain itself.

The government may raise taxes to generate more revenue to pay down its national debt, increasing costs for average people. Increasing debt could also lead to higher interest rates, making mortgages, car loans and credit card debt more expensive.