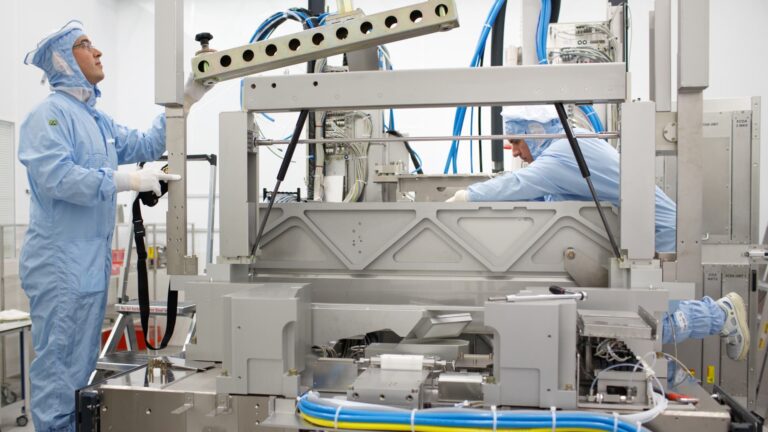

European semiconductor stock ASML is in a “near-quasi-monopoly position” to drive the development of artificial intelligence over the next decade, according to fund manager Marcus Morris Ayton. ASML is a $380 billion Dutch company that is also listed in the U.S. and makes the machines needed to make the world’s most advanced semiconductors. Customers include TSMC, which makes AI chips designed by NVIDIA, AMD and Intel, as well as Samsung and SK Hynix. The company dominates the market for lithography equipment, which is at the heart of the semiconductor manufacturing process. Lithography equipment is a machine that uses light to create the circuits in semiconductors. The company is also currently the sole supplier of extreme ultraviolet (EUV) equipment, which is needed to make the next generation of semiconductors at 3 nanometers. Morris Ayton, co-fund manager of AllianceBernstein’s European growth portfolio, said ASML is facing a transition year after a very strong 2023 due to overcapacity in the semiconductor manufacturing sector. He added that 2025 is likely to be “very strong.” The U.S.-listed stock is expected to rise 25.6% in 2024. The AB European Growth Portfolio offers diversification into ASML with a 7.36% allocation. The portfolio also invests in semiconductor industry giants Infineon, BE Semiconductor, and VAT Group. ASML 1Y Line The company reported in April that first-quarter sales missed expectations but beat profit expectations. Shares fell 7% on the day as the company provided guidance for the current quarter that analysts called “soft.” However, ASML maintained its sales targets for next year, suggesting that Wall Street analysts should view any decline in the stock as a buying opportunity. Wall Street Analyst View “We also like ASML as we believe EUV orders from TSMC and other memory makers will materialize in the coming quarters,” UBS analysts led by François-Xavier Bouvigner said in a May 15 research note to clients. Similarly, Berenberg analyst Tammy Chiu dismissed the weak first-quarter performance, saying: “ASML’s orders vary from quarter to quarter, so the lower-than-expected levels in Q1 are not an indication that the group will not be able to meet its 2025 revenue guidance of €35 billion. We do not expect ASML’s EUV orders to materialize in the coming quarters.” [2024 earnings per share consensus] We are confident that ASML will achieve results above the midpoint of EUR 35 billion. [2025 estimate]”We’re not investing in ASML for the next 12 months,” he told CNBC Pro. “We’re investing in their technology, which is a near-monopoly that will accelerate AI and other technologies for the next decade and decades.” Earlier this week, the company opened a testing lab for its next-generation lithography equipment with Belgian chip researcher Imec. The lab, under construction in Veldhoven, Netherlands, will be built over the course of several years and will give major chipmakers and other equipment and material suppliers an early chance to try out the €350 million ($380 million) equipment, the first of its kind. The “high NA” tool is expected to improve resolution by up to 60%, leading to a new generation of smaller and faster chips. The company reiterated that customers will begin commercial production using the tool from 2025 onwards. “At the end of the day, you need AI, [electric vehicles]”If you need data centers, you need more chips,” Morris Ayton added. “That means you need more EUV tools, and ASML is the only provider that can deliver that.” Wall Street analysts expect ASML’s U.S.-listed shares to rise 13 percent to $1,076 over the next 12 months from the current price of $950, according to FactSet. European-traded shares are expected to rise 15.7 percent to 1,050 euros per share over the same period.