The Wall Street benchmark S&P 500 (SP500) and the tech-heavy Nasdaq Composite Index (COMP:INDStock averages came under selling pressure for a second straight trading day on Thursday as investors continued to pull money out of technology shares.

Netflix (NFLX) is also attracting attention as the top streaming service in the US. Giant schedule The company will report its second quarter results after the close of trading.

A global sell-off in semiconductors on Wednesday sent the Nasdaq (COMP:IND) plummeting to its worst intraday session since September 2022. The index rebounded at the start of regular trading but gave up its gains soon after, remaining in negative territory for the remainder of the day. Withdrew 0.70% It ended at 17,871.22 points.

S&P (SP500) and blue chip Dow (DJI) followed a similar pattern, with the former eventually Down 0.78% The latter settled at 5,544.59 points. Down 1.29% It ended at 40,665.02 points.

“Tech stock trading continues to tighten due to rising valuations and the realization that upcoming earnings reports are likely to mark the start of a move toward stronger earnings growth. This creates attractive risk-reward conditions for stocks that have lagged the market over the past year. Value stocks could benefit, especially if inflation remains robust, paving the way for a longer-term market rotation,” Leo Nelissen, part of the investment group iREIT on Alpha, told Seeking Alpha.

Strong quarterly results and outlook from Taiwan Semiconductor Manufacturing Co. (TSM), the world’s largest contract chipmaker, offered some relief earlier in the day following Wednesday’s semiconductor selloff, but the theme of retreat from technology seen over the last week ultimately outweighed the positive sentiment stirred by the report. All members of the “Magnificent 7” club fell except for Tesla (TSLA) and Nvidia (NVDA).

All 11 S&P sectors ended in the red except for energy.

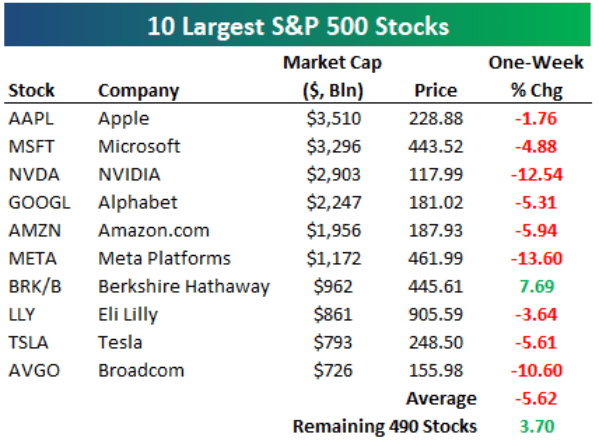

“Going into today, the top 10 stocks in the S&P 500 have lost an average of 5.6% over the past week, while the remaining 490 stocks in the index have gained an average of 3.7%,” Bespoke Investment Group noted on X (formerly Twitter). Below is a chart the company shared.

Monetary policy and economic data also figured prominently on Thursday. Across the Atlantic, the European Central Bank (ECB) left its key policy interest rate unchanged after cutting rates in June. The ECB also said it “does not commit in advance to a particular interest rate path.”

Domestically, traders remain confident that the Federal Reserve will cut interest rates by 25 basis points when it meets in September, a scenario supported by a stronger-than-expected number of Americans filing for jobless benefits last week and signs of further weakness in the labor market.

In the bond market, U.S. Treasury yields rose on Thursday. The yields on the longer-term 30-year (US30Y) and 10-year (US10Y) notes both rose 4 basis points to 4.42% and 4.20%, respectively. The yield on the shorter-term, interest-sensitive 2-year (US2Y) note rose 3 basis points to 4.48%.

See how Treasury yields have performed across the curve on the Seeking Alpha Bonds page.

Turning to the actives, there were some earnings-related moves: Homebuilder DR Horton (DHI) ended with the highest percentage gain in the S&P 500 (SP500) after announcing a $4 billion share buyback and noting “favorable” trends in housing demand despite rising inflation and mortgage rates.

In contrast, Domino’s Pizza (DPZ) fell, the top decliner in the S&P index, after the world’s largest pizza company said it was temporarily suspending its goal of opening more than 1,100 online locations worldwide.