The technology companies that fly just outside of our radar may have the most room for growth this year. Make no mistake, investing means more than buying the seven biggest companies on the stock market; bigger is better, at least over the past year. But what’s worked best recently doesn’t necessarily mean it’ll work in the future. For now, investors may want to check out some Strong-Buy rated stocks to explore the potential to make the most of the technology-driven rally while avoiding the biggest pitfalls along the way.

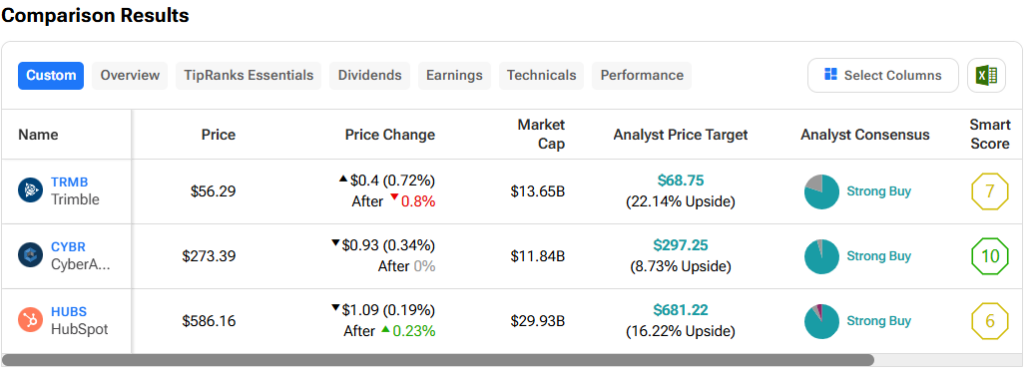

So let’s use TipRanks’ comparison tool to compare and contrast three outstanding tech stocks that have the power to outperform the market’s current leading companies: TRMB, CYBR, and HUBS.

Shares of geospatial technology company Trimble have struggled to sustain their strong gains since bottoming out in November 2023. The technology company, which serves a wide range of industries, is currently in a correction, down nearly 15% from its 52-week high. Despite the share price drop coming just weeks after the company reported a strong first quarter (earnings per share of $0.64 vs. expected $0.62), I remain bullish on Trimble as it looks to launch new products that could drive long-term growth.

Going forward, new scanning systems such as the X9 3D laser scanner, unveiled at Geo Week 2024 earlier this year, may be a timely catalyst to break out of the slump in TRMB stocks. But it’s more than just a fast and accurate 3D screener; its auto-calibration capabilities save users time and reduce some of the human error.

Indeed, these new technologies have made Trimble a niche innovator, and Cathie Wood may have been wrong to downsize it: As of this writing, the company’s shares are trading at 20.2 times forward earnings, well below the 19.9 times average in the science and technology industry.

What is your price target for TRMB stock?

Analysts have rated TRMB shares a “Strong Buy,” with four “Buy” and one “Hold” rating over the past three months. The average target price for TRMB shares is $68.75, indicating an upside potential of 22.1%.

From geospatial technology to cybersecurity, CyberArk Software has a wide reach. Though it’s a small Israeli company (market cap $11.8 billion), it deserves to be mentioned every time it’s on TV after a major breach rekindles interest in cybersecurity companies. With so many cybersecurity companies on the market, each with their own specialization, CyberArk’s offering is one to watch.

CyberArk’s core business is identity security, an up-and-coming sub-scene in the cybersecurity market. As the Israeli-based company continues to improve upon its already impressive identity security platform, it’s exciting to see this small cybersecurity company targeting a vast market.

Despite its size, CyberArk stands out as the market leader in the identity and access management (IAM) market, which could enjoy a compound annual growth rate (CAGR) of 15% between now and 2032, according to the research firm. Fortune Business InsightsWith an astounding 60% growth in subscription annual recurring revenue (ARR) last year, CyberArk looks set to be a cash cow with a promising future.

At the time of writing, CYBR shares are near all-time highs. The stock is trading at the high end of its price-to-sales (P/S) multiple over the past year at 14.5x. But it may be worth paying this high multiple for a fast-growing company in the lucrative field of cybersecurity.

What is your target price for CYBR stock?

CYBR shares are rated a “Strong Buy” by analysts, with 21 Buy and 1 Hold designations over the past three months. The average target price for CYBR shares is $297.25, indicating an upside potential of 8.7%.

HubSpot shares have soared over the past two years, soaring nearly 80%. Though the gains have slowed in 2024, the small business software company could maintain momentum in the second half of the year as IT spending is expected to grow slightly. The company has a lot of AI innovation under its belt, making it an attractive acquisition target, so like analysts, I remain bullish on the stock.

Without a doubt, recent headlines have been dominated by talk of Alphabet’s potential $33 billion acquisition.NASDAQ:GOOGL), robust, AI-powered customer relationship management (CRM) software certainly seems to be the missing piece of Alphabet’s puzzle. The acquisition puts the company in a strong position to compete with software-as-a-service (SaaS) rivals, particularly enterprise giant Microsoft (Nasdaq:MSFT) is working to incorporate AI across its suite.

More recently, it has been reported that other “bidders” have come forward and expressed interest in acquiring the company for an undisclosed sum.

With or without a deal, Hubspot’s focus on AI tools to help customers “work smarter” makes it stand out as an attractive software recovery play and disruptor in the CRM market.At 80.6 times forward price-to-earnings (P/E), HUBS stock isn’t cheap. But with Google and others commanding higher prices of admission, investors may be at risk of underestimating the size of the growth story.

What is your target price for HUBS stock?

HUBS shares are rated a “Strong Buy” by analysts, with 18 “Buy” and 1 “Hold” ratings over the past three months. The average target price for HUBS shares is $681.22, indicating an upside potential of 16.2%.

summary

The following Strong-Buy rated software stocks are worth checking out as they look to capture any market opportunity looming over them: There are clearly significant opportunities outside the market’s top five, such as Trimble and its new 3D scanner, CyberArk’s ever-evolving identity security offerings, or Hubspot’s AI-first software that are catching the attention of “bidders.” Of these three stocks, analysts see the most upside potential (22%) in TRMB stock.

Disclosure