RHJ

Climate change concerns and the urgent need for clean, renewable energy have never been greater. A transformation in sustainable energy markets is underway. And there is no sustainable energy future without uranium. There is no other choice. There is something similar. So why not invest in a company that mines it? Sprott Jr. Uranium Mining ETF (Nasdaq:URNJ) is one of the largest small and mid-cap stocks, offering investors the opportunity to capitalize on the growth potential of uranium mining and exploration companies.

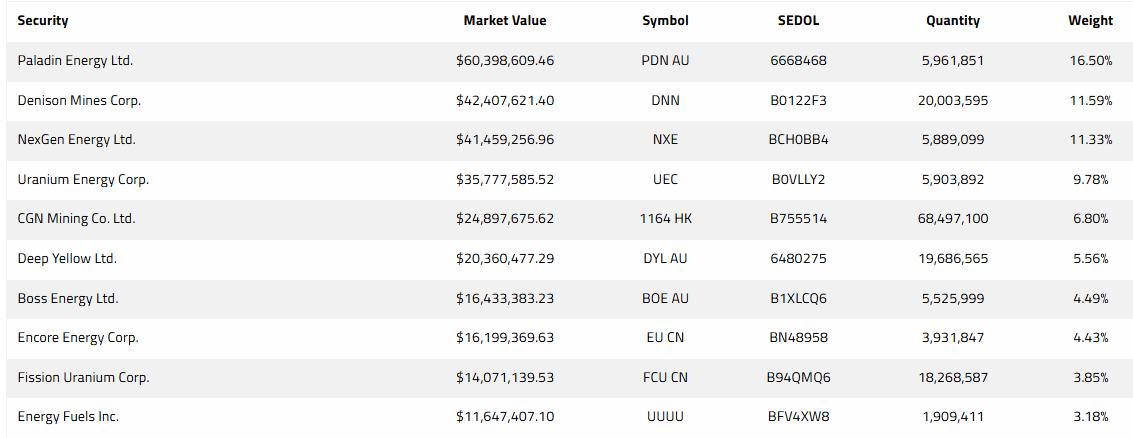

Overview of assets held

URNJ Currency holds 32 stocks, with a fairly large exposure to the top 5 stocks, which make up 56% of the fund. This is concerning, but may also make sense given that there are many smaller market cap companies, which could make the fund more volatile. Liquidity/volume risks are even more serious than already feared.

Sprott ETFs.com

The top three positions are good examples of what you are investing in. Paladin Energy Ltd. develops, operates, explores and evaluates uranium enriched mines. Paladin has uranium operations, development and exploration projects in Namibia, Australia and Canada, with its primary uranium mining project being the Langer Heinrich mine in Namibia. Denison Mines Corp is a Canada-based resource exploration company whose primary business activity is exploration, appraisal and processing exploration activities focused on uranium-bearing properties in Canada. NexGen Energy Ltd is a Canadian company involved in the acquisition, exploration and development of high-grade uranium projects with the objective of providing clean energy, most notably the Rook I project in the Athabasca Basin in northern Saskatchewan. All of these companies, as you can see, are pure uranium operations.

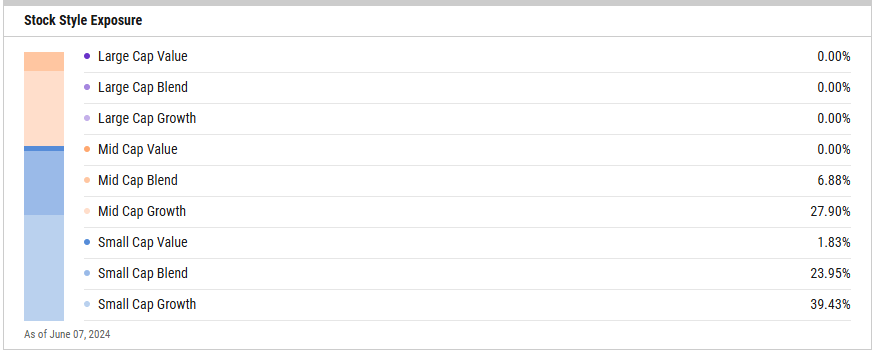

In terms of what the portfolio tracks, we use the Nasdaq Sprott Jr. Uranium Mining Index, a proprietary index jointly developed by Nasdaq and Sprott Asset Management LP that tracks the performance of mid-cap, small-cap and other companies that own or explore for uranium or trade in mining or uranium mining-related businesses.

From this perspective, it’s truly a pure play investment. However, note that the fund name includes the word “junior” because over 60% are small cap (under $2 billion). There are many risks and potential rewards when dealing with companies of this size.

translation

Peer Comparison

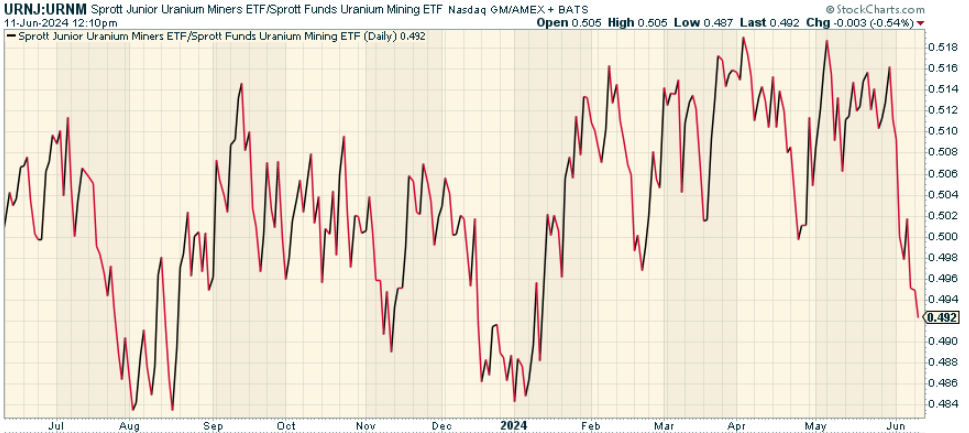

While URNJ is the only pure-play junior uranium mining company ETF, it is not the only way to gain exposure to the sector. Sprott Uranium Mining ETF (URNM) is a more diversified uranium ETF, with a mix of mid-cap and large-cap uranium mining companies. Looking at the price ratios of URNM and URNJ, it’s interesting to note that they were in a wide range. But their overall performance was roughly the same. There doesn’t seem to be a clear dividing line on which one to focus on in terms of market cap, whether it’s on the larger side or not.

Stock Chart

Pros and Cons

On the positive side, URNJ allows investors to participate in the potential for significant upside in uranium through junior mining companies. Additionally, a diversified portfolio across mining and exploration companies provides investors with exposure to the entire uranium mining industry. Diversification can help mitigate the impact of company-specific risks associated with the mining industry, such as operational issues, regulatory issues and project delays.

However, there is no denying the volatility of uranium juniors. Many companies start out with limited capital, making them particularly sensitive to the ups and downs of the capital markets and the challenges unique to the uranium mining industry. Add to this complexity the geopolitical risks, regulatory uncertainty and environmental challenges facing the uranium mining industry.

Conclusion

From a macro perspective, the clean energy transition is a powerful story, and the Sprott Junior Uranium Miners ETF is a strong fund to access this theme from a pure perspective, as far as being more speculative, given that it focuses on the upper end of the cap scale of uranium mining. Junior uranium miners are a maturing sector in the clean energy transition story, and I think this is a good fund to consider for a small allocation.

Predicting crashes, corrections and bear markets

Predicting crashes, corrections and bear markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing Lead-Lag Reports, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to access and try the Lead-Lag report free for 14 days.