Finally, Japan’s Ministry of Finance intervened on Monday when the USDJPY exchange rate exceeded the 160.00 handle. The pair fell 500 pips before rebounding at the 155.00 handle and some key levels as the bulls bought the dip. The problem here is that central bank intervention won’t work unless fundamentals change. The effect is generally short-term and the market dampens the move by buying and selling at even better levels.

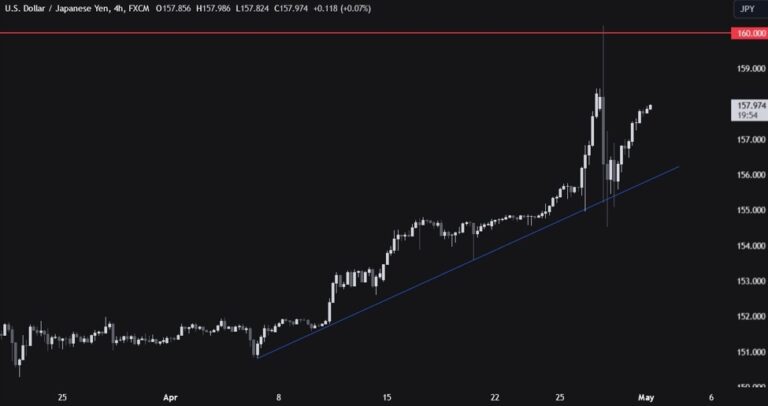

US dollar yen 4 hours

On the 4-hour chart, we can see that the 160.00 handle is a clear line in the sand. The pair rallied around the 155.00 handle, where the recent swing low level and trendline are located. All else being equal, it is very likely that the pair will return to the 160.00 handle and profit-taking may be rejected amid concerns that another intervention could lead to a pullback.

US dollar yen 1 hour

On the hourly chart, we can see that there was a resistance zone around the 157.00 handle, but the rise in ECI in the US Q1 subsequently drove in more buyers and caused a breakout. There is talk that the Japanese can change the current situation if the Bank of Japan raises interest rates by surprise. I don’t understand why they would risk increasing wages and increasing inflation just to get a limited benefit. From a risk management perspective, this doesn’t seem like a good strategy.

Given this, the only way the trend could reverse is if U.S. economic data worsens and three or more interest rate cuts bring market prices back up. Many of the hawks have already priced in, but the pair continues to rise as the carry trade remains impressive. The contrarian here will focus on a short position in the yen and wait for the right trigger to build up. At this time, there are no such triggers. Yes, there are signs of weakness in some soft data, but hard data continues to make surprising gains. Markets will want to see some support from concrete data and confirmation of any major downside expectations, such as the ISM PMI, before reversing the trend.