On-chain data shows that Bitcoin’s Coin Destruction Days (CDD) has reached an all-time high (ATH). Here’s what could be behind this trend:

Bitcoin CDD records bigger surge than November 2018

BTC CDD has skyrocketed, as CryptoQuant Community Manager Maartunn pointed out in a post by X. CDD is an on-chain indicator based on the concept of a “coin day.”

A coinday is the amount that 1 BTC accumulates after lying dormant on the blockchain for a day, so if a coin sits in the same wallet for a certain number of days, it will earn the same number of coindays.

When such dormant coins are eventually moved on the network, the coin-days counter will naturally reset to zero and any coin-days held until then will be considered “destroyed.” The CDD tracks the number of coin-days that are destroyed across the network on any given day.

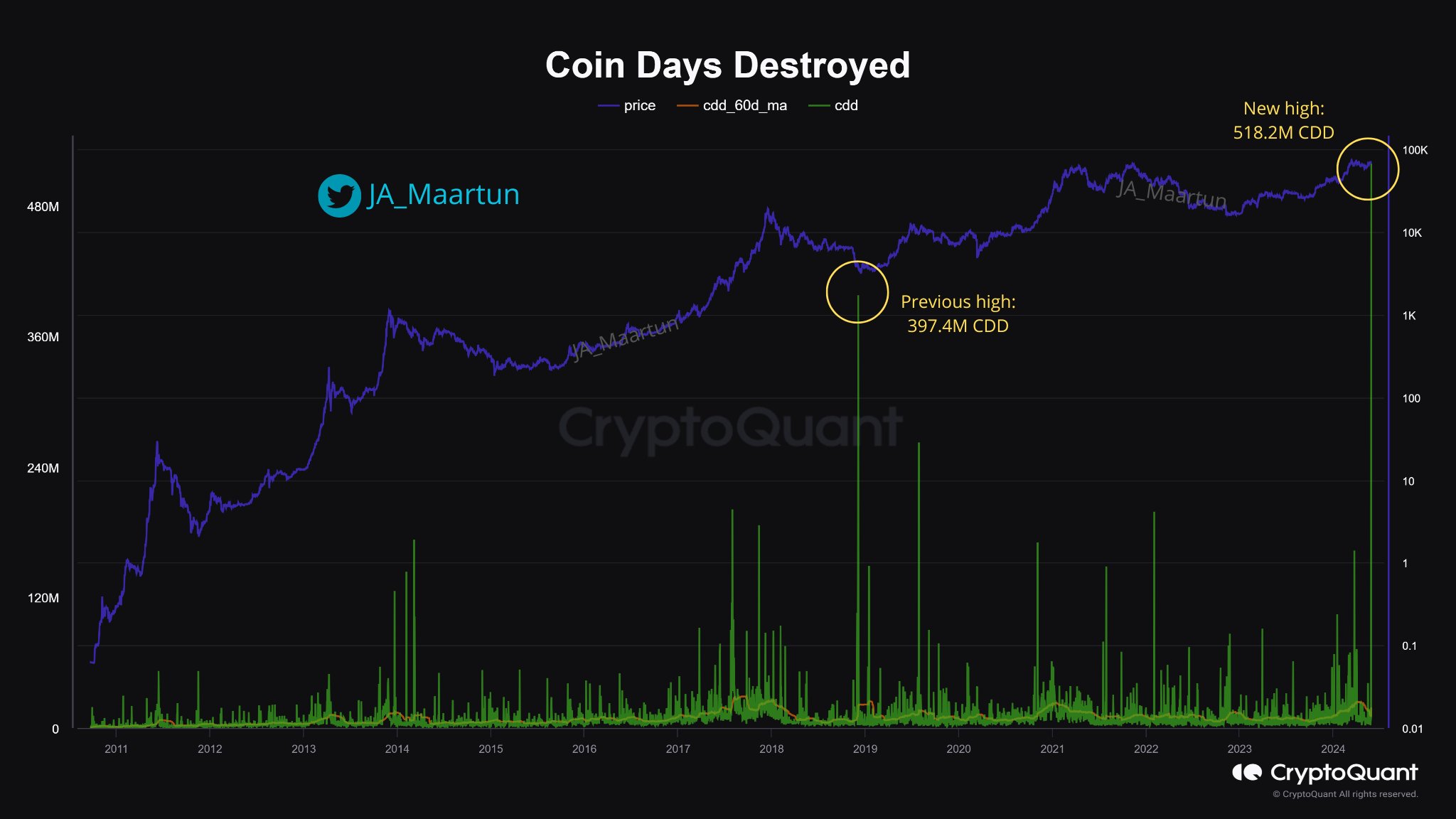

Below is a chart showing Bitcoin CDD trends over the history of the cryptocurrency.

Looks like the value of the metric has been quite high in recent days | Source: @JA_Maartun on X

As the chart above shows, Bitcoin CDD recorded a sharp increase, indicating that many coin days were reset by transactions on the network.

Typically, spikes in such metrics are associated with Long Term Holder (LTH) activity. Investors belonging to this cohort tend to HODL tokens for long periods of time, and therefore naturally accumulate large amounts of coin days.

When these determined hands finally make a trade, the accumulated coin days will be flushed and the metric will reach high values. Typically, LTH breaks its silence when it wants to sell, so a spike in the indicator could be a potential sign that these diamond hands are joining in the sell-off.

CDD’s most recent surge has seen 518.2 million coins destroyed, and from the chart we can see that this is significantly higher than the all-time high of 397.4 million recorded during the November 2018 crash.

On the surface, it seems like the most dormant LTH may have had the biggest selloff in history, but dig a little deeper and it becomes clear that there is a specific reason for this CDD surge: the Mt. Gox trade.

The bankrupt cryptocurrency exchange previously disclosed plans to pay its creditors, so the transfer is likely related to those plans.

The Bitcoin stacks managed by the platform had been dormant for quite some time, meaning that many coindays were bound to have accumulated, and the movement of these coins destroyed a record number of coindays in a short period of time.

BTC Price

At the time of writing, Bitcoin is trading at around $67,500, down 4% over the past week.

The price of the asset appears to have registered some decline recently | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com