- Downward pressure on XRP may be losing momentum

- Although market bears still maintain significant influence over the overall market,

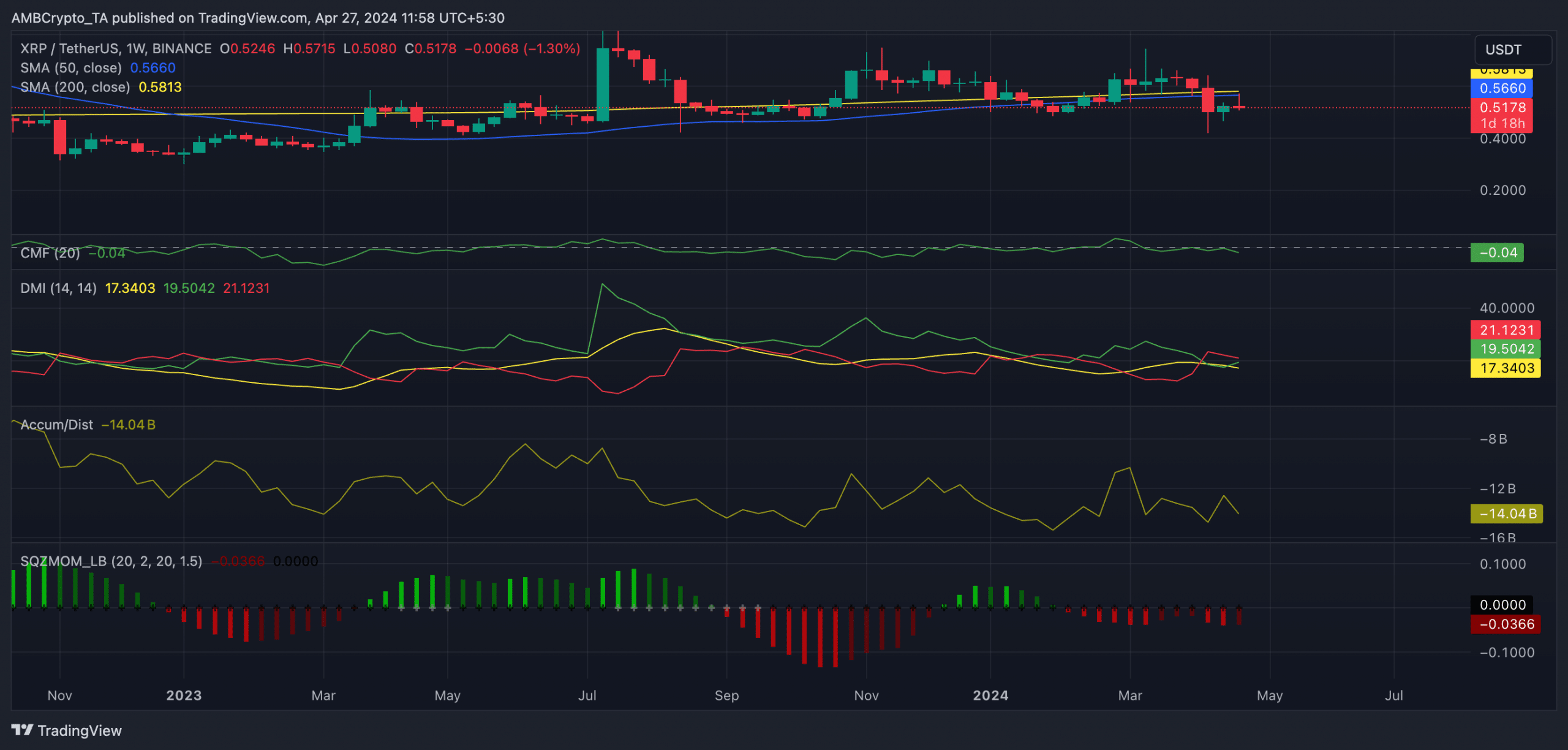

The long-term downward trend of XRP has been weakening recently, and the difference between the 50-day (blue) and 200-day (yellow) simple moving averages (SMAs) on the weekly chart is narrowing day by day.

An asset’s 50-day SMA is a short-term average that reflects recent price movements. The 200-day SMA, on the other hand, is a long-term average that indicates the direction of an asset’s general trend.

When the difference between two moving averages narrows and the 50-day SMA is below the 200-day SMA, as is the case with XRP, it often signals a weakening downtrend.In other words, XRP is The short-term average is moving closer to the long-term average, indicating that downward momentum has been lost.

the bear may have it all

While the downward pressure on XRP may be waning, readings of other key technical indicators reveal that bearish sentiment remains high.

For example, the company’s Chaikin Money Flow (CMF), which measures the flow of funds into and out of assets, was negative at the time of writing and has remained negative since March. Negative CMF values indicate market selling pressure or a spike in the coin distribution. This suggests that the asset is being sold more than it is being purchased, and money is flowing out of the asset.

Supporting the decline in XRP accumulation, the accumulation/distribution line (ADL) was also trending downward at the time of writing.

This indicator tracks the cumulative flow of funds into and out of an asset over a specific period of time. A decline like this means that market participants are selling more than they are buying.

read ripple [XRP] Price prediction for 2024-2025

Additionally, the XRP Squeeze Momentum indicator, which measures XRP momentum and tracks market consolidation stages for traders looking to trade in a sideways market, flashed a red downward bar. The value of this indicator has been negative since January.

When you see these types of bars, the asset in question is recording southward momentum.

The token’s negative directional index (red) is above the positive index (green), suggesting that XRP’s bearish strength is outweighing its bullish strength. When these lines trend like this, selling pressure outweighs buying momentum on the chart.

Source: XRP/USDT on TradingView

At the time of writing, XRP was valued at $0.51. Its value has fallen by nearly 20% over the past month, according to data from . coin market cap.