As Yieldstreet tries to distance itself from a rocky past with a new name and ad campaign, its customers are dealing with a present reality that is increasingly dire.

The private markets investing startup, freshly rebranded as Willow Wealth, last week informed customers of new defaults on real estate projects in Houston, Texas, and Nashville, Tennessee, CNBC has learned.

The letters, obtained and verified by CNBC, account for about $41 million in new losses. They come on the heels of $89 million in marine loan wipeouts disclosed in September and $78 million in losses revealed by CNBC in an August report.

In total, Willow Wealth investors have lost at least $208 million, according to CNBC reporting.

Willow Wealth also removed a decade of historical performance data from public view in recent weeks. A chart on the company’s website showing annualized returns of negative 2% for real estate investments from 2015 to 2025 — down from 9.4% gains just two years prior — has been taken down.

“They had to change their name,” said Mark Williams, a professor at Boston University’s Questrom School of Business. “Their old name had negative value to it, so they’re trying to do a 2.0 to restart things. They’re also making it harder to uncover their poor performance by removing the stats, which is alarming.”

The high-stakes rebranding is the latest chapter for a company that sought to empower retail investors, but instead left some of them saddled with deep losses and years of uncertainty.

Under its former name, Willow Wealth — backed by prominent venture firms and buoyed by aggressive online marketing — had been the best known of a wave of American startups that promised to broaden access to the alternative investments that are the domain of institutions and rich families.

But the still-unfolding collapse of its real estate funds demonstrates the risks the private markets hold for retail investors. By their very nature, private investments don’t trade on exchanges and lack standardized disclosures. That leaves investors especially reliant on private fund managers, both for information and to safeguard their interests for years while their money is locked up in deals.

Private markets have gained in prominence this year after President Donald Trump signed an executive order to allow the investments in retirement plans.

While critics say that opaque, illiquid investments with high management fees aren’t appropriate for ordinary investors, asset managers including BlackRock and Apollo Global Management see retail as a vast untapped pool of capital. Retirement giant Empower said in May that it would allow private assets into the 401(k) plans of participating employers with help from firms including Apollo and Goldman Sachs.

New mascot, same pitch

Against this backdrop, Willow Wealth CEO Mitch Caplan, a former E-Trade chief who took the helm in May, said the company was heading toward a new model. Instead of only offering deals sourced by the startup, it would also sell private market funds from Wall Street giants including Goldman and Carlyle Group.

The company no longer provides the historical performance of its offerings because of the pivot to third party-managed funds, according to a person with knowledge of the situation who asked for anonymity to discuss internal strategy.

“Transparency is paramount to us, and we consistently provide strategy-specific performance information for each manager at the offering level to support informed decision making,” said a Willow Wealth spokeswoman.

As for CNBC’s reporting on the new real estate defaults and rising tally of losses, the Willow Wealth spokeswoman called it a “rehash” of news on “investments from five years ago.”

“The investments in question represent a very small portion of our overall portfolio and do not reflect the current nature of our offerings or business focus,” she said.

The firm declined to say how much it manages in assets.

The startup — founded in 2015 by Michael Weisz and Milind Mehere, who remain on Willow Wealth’s board of directors — told customers that private investments would provide both higher returns and lower volatility than traditional assets.

Willow Wealth’s pitch hasn’t changed much, despite the rebrand.

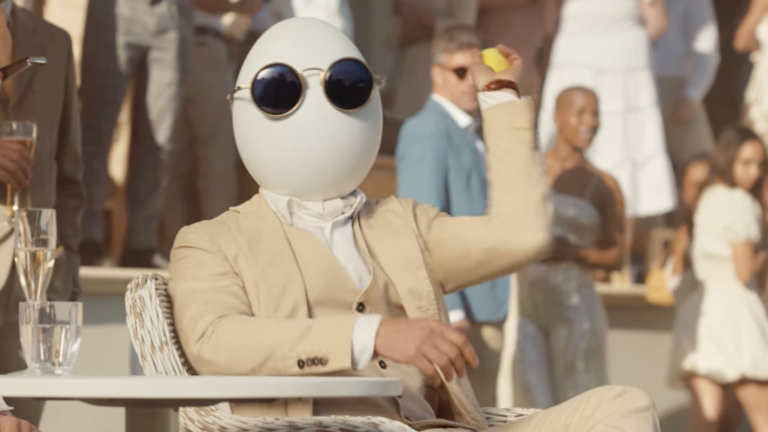

In a new ad campaign, a character called Hampton Dumpty says that he’s “learned a thing or two about crashes” and therefore uses Willow Wealth to diversify his portfolio with private market assets including real estate.

The mascot, a play on the Humpty Dumpty nursery rhyme, tells viewers that “portfolios including private markets have outperformed traditional ones for the past 20 years.”

Compounding fees

On its revamped website, the firm has a chart showing a hypothetical portfolio made of private equity, private credit and real estate outperforming traditional stocks and bonds over the decade through 2025.

But the chart doesn’t include the impact of fees, which are typically far higher for private investments than for stock ETFs and mutual funds. The company also notes in a disclosure that customers can’t actually invest in the private market indices listed.

While most stock ETFs carry fees below 0.2%, Willow Wealth typically charges 10 times more than that, or 2% annually on unreturned funds, for its real estate offerings, according to product documents.

Willow Wealth also charged an array of one-time fees associated with the creation of the funds, including for structuring the deal and arranging the loans.

Fees for Willow Wealth’s new products are even higher. The company charges about 1.4% annually for access to portfolios made up of private funds from Goldman Sachs, Carlyle and the StepStone Group, according to its website.

Those firms also charge their own fees, leading to all-in annual costs ranging from about 3.3% to 6.7% per fund, according to the providers’ documents.

That makes Willow Wealth’s products among the most expensive in the retail investing universe.

‘Difficult news’

For customers still coming to terms with their losses and who remain in limbo on funds that the firm says are on “watchlist” for possible default, Yieldstreet’s transformation into Willow Wealth looks like an effort to evade accountability, the customers told CNBC.

After last week’s disclosures, nine out of the 30 real estate deals reviewed by CNBC since August are now in default. That 30% failure rate is high, even by the standards of the private assets world, said Boston University’s Williams.

Though the realm of private credit is more opaque, making average default rates difficult to pinpoint, some in the industry estimate typical failure rates of between 2% and 8%.

Whether they were apartments in hot downtown areas or established cities, or single family homes scattered across Southern boomtowns, projects that Willow Wealth put its customers into struggled to hit revenue targets and fell behind on loan payments.

Willow Wealth has blamed the failures on the Federal Reserve’s interest rate hiking cycle in 2022, which made repaying floating-rate debt harder.

Among newly-disclosed defaults are a pair of funds tied to a 268-unit luxury apartment building in East Nashville called Stacks on Main.

Investors hoping to earn the advertised 16.4% annual return put a combined $18.2 million into the two funds, according to documents reviewed by CNBC. They later added another $2 million in a member loan meant to stabilize the deal.

Stacks on Main apartment complex in Nashville, Tenn.

Courtesy: Google Maps

“Your equity investment is expected to incur a full loss” after selling Stacks on Main on Nov. 25, Willow Wealth told customers in a letter dated that same day. Investors in the member loan will lose up to 60%, the company said.

“We understand this is difficult news to receive,” Willow Wealth told customers. “We share in your disappointment.”

Documents for the 2022 transactions listed Nazare Capital, the family office of former WeWork CEO Adam Neumann, as the sponsor for the deal. Real estate sponsors typically source, acquire and manage deals on behalf of investors.

In 2022, after his WeWork tenure ended, Neumann founded property startup Flow, which took on some of the real estate deals from his family office.

In public comments to news outlets over the past year, representatives from Flow have sought to distance the company from the travails of then-Yieldstreet.

But according to the 2022 investment memo, Nazare purchased Stacks on Main in July 2021 for $79 million and then offloaded a majority stake to Yieldstreet members through a joint venture.

Crucially, the transaction saddled the joint venture with $62.1 million in debt, a burden which would later prove instrumental in the deal’s failure, CNBC found.

Israeli-American businessman Adam Neumann speaks during The Israeli American Council (IAC) 8th Annual National Summit on January 19, 2023 in Austin, Texas.

Shahar Azran | Getty Images

“This building was majority-owned by YieldStreet and the property was never operated either by Flow or anyone associated with Adam,” a spokeswoman for Neumann told CNBC. “In any event, the building has been sold and Flow no longer has a minority interest nor any involvement in this property.”

Nazare was also listed as sponsor for another Nashville project that went sideways for retail investors, an apartment complex at 2010 West End Ave. That project resulted in $35 million in losses across two funds, wipeouts that were previously reported by CNBC.

Besides the deals tied to Nazare, there were other defaults.

A project called the Houston Multi-Family Equity fund, made up of apartments across suburban Texas, resulted in a loss of all $21 million of customer funds, the startup told investors in a Nov. 25 letter.

“The property was unable to generate sufficient revenue to pay monthly debt service and operating expenses” and went into foreclosure, resulting in a “full loss of the equity,” Willow Wealth said.

A ‘high-risk’ trap

The tally of Willow Wealth’s investor losses is likely to rise further.

For instance, an $11.6 million loan made by Willow Wealth customers for a Portland, Oregon, multifamily project is “currently in default” after an appraisal found that the borrower owed more than the real estate was worth, the company told investors.

Willow Wealth is trying to restructure the borrower’s loan to avoid selling the property for a loss, the company said in a letter to investors.

The company has also warned investors that a Tucson, Arizona, apartment complex and two projects made up of single-family rental homes across Southern states were likely to result in future losses of unspecified amounts, according to separate letters. Investors put more than $63 million combined into those deals.

Williams, the Boston University professor and a former Federal Reserve bank examiner, said he taught a class this fall on how Willow Wealth and other fintech firms failed to protect their customers.

“They claimed they were going to democratize access to the types of deals only the rich had,” Williams said. “In reality, they created a high-risk trap for investors.”