It’s easy to see why investors are attracted to unprofitable companies. For example, biotechnology companies and mining exploration companies often lose money for years before achieving success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the large number of unprofitable companies that burn through all their cash and go bankrupt.

you should sophia genetics (NASDAQ:SOPH) shareholders worried about cash burn? In this article, cash burn refers to the annual rate at which an unprofitable company spends cash to fund growth. Free cash flow is negative. First, we compare its cash burn to its cash reserves to calculate its cash runway.

Check out our latest analysis for SOPHiA GENETICS.

When will SOPHiA GENETICS run out of funding?

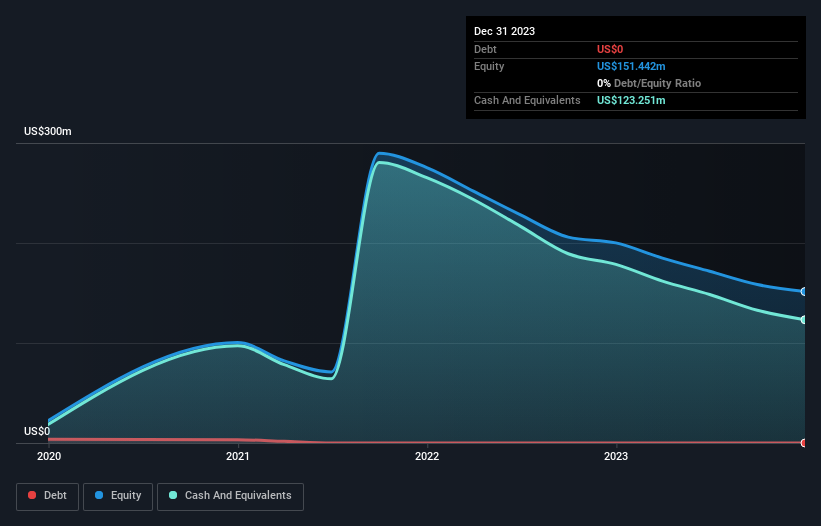

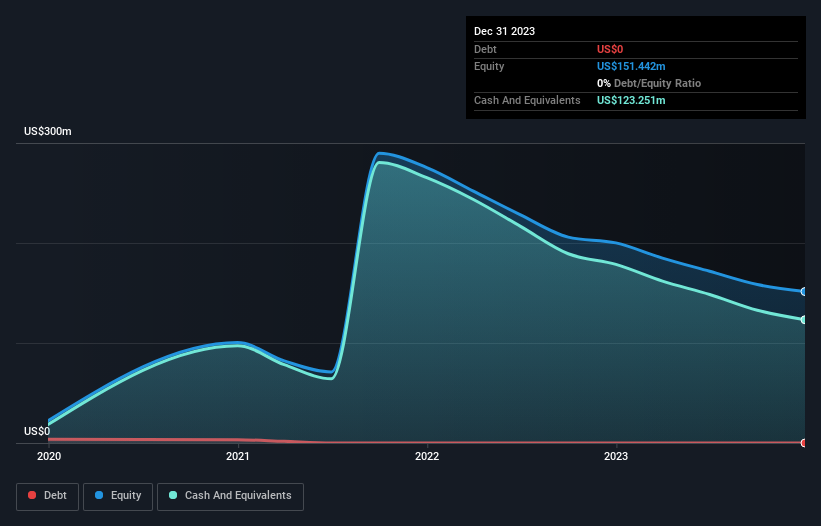

A company’s cash runway is the amount of time it takes to use up its cash reserves at its current cash burn rate. As of December 2023, SOPHiA GENETICS had cash of his US$123m and no debt. Importantly, its cash burn in the trailing twelve months was US$58m. This means it had a cash runway of approximately 2.1 years as of December 2023. This is a reasonable number considering the company takes several years to develop its business. You can see how its cash holdings have changed over time, as shown below.

Is SOPHiA GENETICS growing steadily?

We consider the fact that SOPHiA GENETICS was able to reduce its cash burn by 28% in the last year to be quite encouraging. On top of that, operating revenue was up 31%, an encouraging combination. It seems to be growing smoothly. However, it is clear that the key factor is whether the company will grow its business going forward. That’s why it makes so much sense to see what analysts are predicting for the company.

Can SOPHiA GENETICS easily raise more cash?

There’s no doubt that SOPHiA GENETICS is in a pretty good position in terms of managing its cash burn, but even if that’s just a hypothesis, it’s unclear how easily it can raise more capital to fund its growth. It’s always worth asking. Generally, listed companies can raise new cash by issuing stock or taking on debt. One of the main advantages of publicly traded companies is that they can sell stock to investors to raise cash and fund growth. You can compare a company’s cash burn to its market capitalization to find out how many new shares a company needs to issue to finance its operations for one year.

SOPHiA GENETICS has a market capitalization of US$324m, and last year it burned through US$58m, or 18% of its market value. As a result, we’d venture that the company could raise more cash for growth without too much trouble, even at the cost of some dilution.

How risky is SOPHiA GENETICS’ cash burn situation?

SOPHiA GENETICS appears to be quite healthy when it comes to its cash burn situation. Not only did we do very well in terms of financing, but we also had very good revenue growth. We’re the kind of investors who are always a little concerned about the risks associated with cash-guzzling companies, but given the metrics discussed in this article, we feel relatively comfortable with the situation for SOPHiA GENETICS. Masu. After a thorough risk review, we found the following: 2 warning signs for SOPHiA GENETICS What you need to know before investing.

of course Sophia Genetics may not be the best stock to buy.So you might want to see this free A collection of companies with a high return on equity, or a list of stocks that insiders are buying.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.